Joe Biden wants us to think that the economy is doing great. In fact, the Biden economy has large numbers of Americans living on the edge.

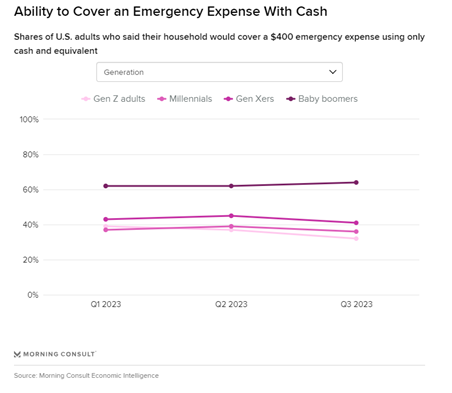

Morning Consult survey found that only 32 percent of Gen Z report that they could pay for an unanticipated emergency expense with cash. Just two quarters ago, 39 percent of Gen Z could handle a $400 emergency expense.

The normal pattern of saving over one’s lifetime is that as one ages holdings of financial assets should grow as one saves for retirement.

However, the Morning Consult survey shows that Millennials and Gen X are making very little progress in building wealth.

The survey found that only 36 percent of Millennials and 41 percent of Gen X said that they could handle an unanticipated $400 expense. These percentages are not materially different from Gen Z.

Seen differently, Gen Xers are now more than twenty years into their adult lives and their finances are not much more stable than the finances of new college graduates.

The survey also asked whether the $400 expense would require putting off payment of other bills. 38 percent of Gen Z and 39 percent of Millennials and Gen X would have to put off payment of other bills.

It’s not just Americans. A video posed by TikTok user Simone (@simonesdays) shows how after paying taxes and bills, the paycheck from her CAD75,000 corporate job leaves her with exactly in $80 spending money for the next two weeks.

Her TikTok video has been viewed 2.7 million times and has 184,000 likes as of Friday the 4th.

Here are some of the comments on her TikTok page from other young people struggling to get by.

At the core of the financial struggles of young Americans is a lack of economic opportunity. The inability of the Millennials and Gen X to improve their finances so that they are closer to the Baby Boomers than Gen Z is particularly concerning.