A new survey of the financial condition of Americans shows that nearly one in two Millennials and Gen Zers report that they regularly run out of money. And this is before the likely recession in 2023.

Janet Yellen might not see signs that Americans are hurting but a new survey of personal financial conditions tells a different story.

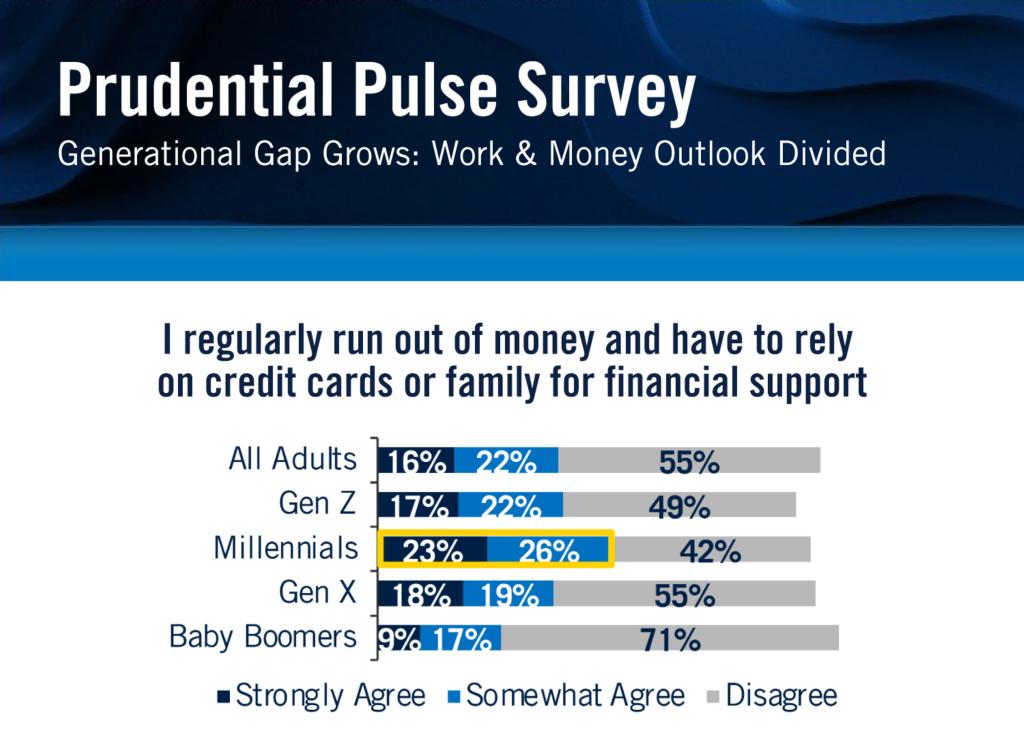

Prudential Financial’s most recent Pulse Survey found that 49 percent of Millennials and 40 percent of Gen Zers report that they regularly run out of money and have to rely on credit cards or parents for financial support.

The survey also found that 46 percent of Gen Z and 42 percent of Millennials say that they would not be able to support their current lifestyle without parental support.

Financial difficulties are a major source of stress for young Americans. Half of the Millennials surveyed reported that they had trouble sleeping during the past year because of financial stress.

The financial difficulties facing the Millennial generation are particularly concerning because most Millennials should be well into their careers at this point.

The Millennial generation is typically defined to include those born in 1981 through 1996. The youngest Millennials are 26 and the oldest 43.

That so many young Americans are struggling financially underscores the weakness of the Biden economy.

And this is before the much-anticipated recession of 2023.

GOUSA is working for greater opportunity for all Americans. Our economic policy agenda and rating system for politicians allows us to pinpoint which elected leaders support greater opportunity for Americans and those that don’t.

If you believe as we do—that economic opportunity is best achieved through the free enterprise system and smaller government rather than central planning and government control—then won’t you join our team or send us a donation? You’ll be glad that you did.